I write generally about three topics on this site:

- Personal Finance

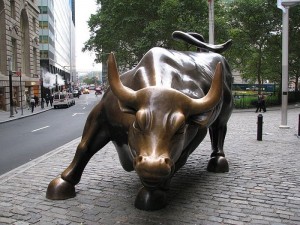

- Investing

- Economics

I list them in that order based on what I perceive as the general public’s interest level. Most people are concerned with getting out of debt and maintaining a budget – Personal finance issues. Those who have succeeded at those tasks become more interested in how to put their savings to work for them and become interested in investing. Very few people proceed to an interest in policy and economics, and perhaps rightly so. It’s certainly not immediately clear that an understanding of economics is beneficial to your personal wealth.

The Case for Economics

There are obvious reasons to believe that an understanding of economics should be a great asset in your financial life. Inflation is one of the examples. If I judge accurately what future inflation will look like, this can greatly improve my ability to choose good investments. If I can look at upcoming legislation and see what its effects will be, I should be able to capitalize on that. It seems like a slam dunk that an economic view should be a great boon to my financial freedom.

However…

Sadly, economists have a habit of being spectacularly wrong. Even when they aren’t completely wrong, it’s very difficult to profit off of their decisions. For example, right now treasuries are already priced very low because of a perception that inflation in the future will be high. So even if that perception is correct, the expected price change is already “baked into the cake;” and if they’re wrong, there’s a chance for spectacular loss.

So Why Bother?

Despite all this I have a nasty habit of continuing to write about the big picture, particularly policy. One reason I do this is because I believe that a basic understanding of economics can help you make wise decisions in your day to day life, not just in your investing life. The law of supply and demand may not be useful in deciding whether to buy Microsoft, but it can be useful in starting a business or in deciding what political policies to pursue. While the value of economic understanding may be questionable for investing purposes, its value in life is much less questionable.

The More Things Change

Many sage investing professionals have a saying: The most dangerous words in the English language are this time it’s different. Each time that politicians proudly proclaim that we’ve defeated the boom and bust cycle for example, we know how the story always ends. The more things change, the more things stay the same.

(more…)

We’ll all just agree to pretend last weeks Wednesday had some links in it, okay? Haven’t been reading as much this week so I thought I’d go with fewer links and more discussion:

We’ll all just agree to pretend last weeks Wednesday had some links in it, okay? Haven’t been reading as much this week so I thought I’d go with fewer links and more discussion: